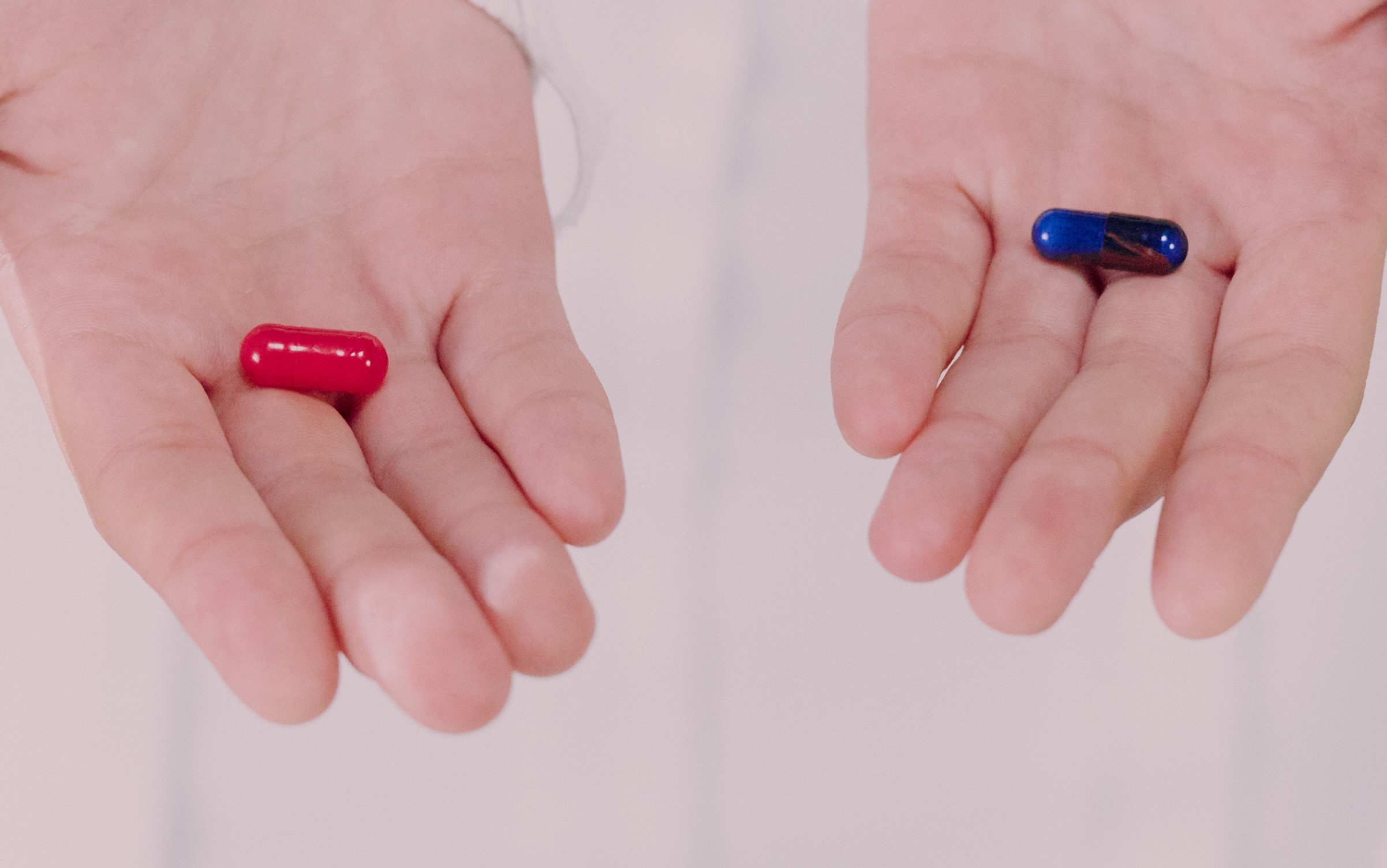

The Blue Pill came from the Matrix (1999), an idea that we are all born in our respective ‘bubbles’ (a universe that is made up of who we are, our formative life experiences & belief systems, our ego states, and the easily imbibed beliefs that come from the straight path that we are naturally designed to follow).

The pathways of our “learnability” are often determined by other social rules such as the Collective Unconscious (the ‘culture’ or the capability of the Herd).

In Richard Bach’s “Jonathan Livingston Seagull”, he recounts the story of a seagull who decided to “learn the finer points of flying”, as compared to the flock, which focused on learning how to “fish”. As a result, Jonathan became ‘different’ and more productive, and hence developed social problems with the rest of the flock.

What’s Red Pill?

The boundaries of the Learnability of the Herd, are decided by the rules of survival, not the rules of innovation, productivity & creativity. This is what Carl Jung called the Collective Unconscious.

The Red Pill is a term that evolved from the Blue Pill: the sudden changes that we seek, find & accept as we question our blue-pilled beliefs: a flat-earther who questions the shape of the Earth and works hard to accept the counter-intuitive Reality that the Earth is really round.

We come across the Blue Pill everywhere in our Life: like fish that don’t “know” the existence of water, or mammals who don’t “know” about air, we lie in Blue Pills that we don’t even know, have enveloped our Consciousness & are rooted deep in our subconscious.

Why do we hate Volatility, and are willing to pay a grievous price to avoid Volatility?

The Insurance industry is one of the most profitable industries in the long term because it promises us the protection of very visible, macabre risks that we imagine to be much worse than they really are (because we imagine vividly, in stark pictures). So earthquakes & fires, car accidents, etc., are vivid things in our heads, for which we are willing to pay for protection, at rates that we cannot calculate accurately. That’s why LIC is the largest, richest corporation in the country. As is Warren Buffet…

Red Pilling, is the process of scientifically & consciously seeking an accurate perception of this sub-conscious Reality: what if we stop insuring our cars, and invest in “self-insurance” instead: the idea that better, safer driving is the process of taking back control for the possibility of ‘accidents’? You might discover (as have many people) that “self-insurance” improves your risk-taking behavior & gives you a superior Risk-Reward….

Asking Uncomfortable Questions

Can you see how this applies to Investing, Trading, Markets, even Business & Health…..if you think about it, and even Relationships? It’s actually a Life Skill, and will materially change your perspectives & belief systems, once you make it a habit to start asking some embarrassing questions about the Truth that you encounter in your Life.

So ‘Red Pilling’ is what Pythagoras did when he asked: what if Earth is NOT flat? What else could it be? Not very different from how we accept the “market prices” given by Mr. Market as God’s-Own-Truth, simply because we’re too lazy to have any opinion of our own. We go on to believe that “markets are efficient” (which they might be, but only over the long term)…..a.k.a. Bhav Bhagwan Che.

If we shift to “red pill” viewing, we will ask questions: if humans are often irrational, how can markets be efficient? Is the herd always better at judging nuances, than individuals? If the very existence of volatility tells us that the market cannot make up its mind, then how accurate & trustworthy is the market’s assessment? Is Volatility because of new information, new opinions, or just plain confusion?

Sociology & Gender Relations

As a skill, Red Pill is a filter that we can turn on at will, a skill akin to putting on a pair of spectacles that show Life in a different dimension. It sets up a different set of beliefs and views of Reality through a different paradigm. This is an underlying theory that explains the evolving Reality better than your previous Blue Pill understanding of Reality.

It has umpteen uses: In Sociology & Gender Relations, it is a set of Knowledge & Knowhow that facilitates the construction of Reality (that pertains to men’s place in society and to intersexual dynamics). It deviates from the dominant social narratives prevailing on those topics.

The Red Pill is NOT ‘male feminism’. It’s not anti-women, in fact, it’s a worldview that women can use to improve their relationships with their chosen men. Just as being “red-pilled” might change your understanding of Reality, but doesn’t change anything else. You still do what you do but with a different perspective…

It’s more like a spiritual transformation: like a sailor (who was earlier a flat-earther) who now understands that the Earth is round. Now when he goes back to his sailing life, he has a different understanding & perspective.

The Enlightenment

Enlightenment: better not start it. Having started, never finish.

You know you have integrated the Red Pill when you are no longer angered by the truths that it reveals. We get angry by what we don’t understand, so we’re not angry any longer when we have understood it. The anger we feel is a direct conflict with our underlying belief systems. This is often seen most violently in religious discourse, or tribalism, in which beliefs sit at the lowest level of our Herd Consciousness.

Reality is what it is: getting angry at Reality indicates a lack of acceptance (Water is Wet). It’s our job to conform our understanding with Reality, NOT to work to change Reality to our understanding (Blue Pill).

Before Enlightenment, chop wood, carry water…..AFTER Enlightenment, chop wood and carry water. This is a very important piece of advice. A change in our beliefs, philosophies, or even our Reality Construct, should not change our apparent behavior, but the principles that we use to apply to the same situations.

Political Correctness is not about “correctness”

A belief that Political Correctness is more about ‘correctness”, is a Blue Pill construct. We believe that “being nice” is the right behavior, but it might just be obedience to the Will of The Herd. A child who grows up in a politically correct culture may never learn to SEEK THE TRUTH. Conversely, a ‘disobedient’ child who questions the Public Consensus, may find himself in “politically incorrect” territory, but with a better construct of Reality through the Red Pill.

So try telling yourself that, let’s say, that Markets are NOT efficient, or that “women are NOT the weaker sex”…….and look for evidence that the opposite of your Blue Pill Reality is actually true. And you might be surprised at how much evidence you find to support this new Reality Construct. This can be a habit, by training yourself and building up this silo of disconfirming evidence, which you can evaluate under the glare of actual Reality.

The bubble that we all live in

A related bubble that comes from Blue Pill thinking, is that of the “inside out” view that we have of the world: that we all sit in our own heads and look out. How about thinking of yourself as just a limited actor in a play, with the thinking part of you in the audience? You will eventually get a different view of Reality, which is at once a better view of the chessboard, and also the ability to empathize with how the rest of the world looks at the same Reality.

To come back to Markets, this is a unique ability, and you will quickly understand a very common weakness of The Herd: that Markets are really Herds, but we talk about them indistinguishably from Individuals. So we miss out on the nuance that Herding contributes to individuals when we use the term interchangeably. This is at the root of the criticism that Markets are NOT efficient, often enough for them to be important.

When we attribute Intelligence to Markets, the underlying assumption is that millions of pre-frontal cortices (PFCs) have put their individual minds to a problem and come to an ‘efficient’ conclusion. But we forget those times when the Mind Of The Herd takes over, individuality is lost, while the priorities shift to ensuring the survival of the species. At this point in time, very basic assumptions of economic behavior (“enlightened self-interest”, for example) no longer hold true.

So how does one decide which hat to wear, Blue vs Red Pill? Frankly, there is no fixed one-size-fits-all answer. This is merely a skill to help you choose. But when exactly to exercise that choice, is not something we even claim to know…