Oh Shit!!! : The Things That Scare Me To Death….

The Dow Jones is near a historical high, even as the DXY Index is at a mid-term high. For a currency almost guaranteed to break

Understanding the Role of Emotions and Biases in Economic Decision-Making, Exploring the Psychology Behind Our Choices.

Risk is no doubt derived from Volatility, but is not synonymous with it. Volatility is like the waves of the sea, its depth is you must suffer if you want to walk through the sea. But the Risk at sea is much more than the volatility of the waves

“A large part of Volatility is actually opportunity, which actually reduces long-term Risk for a business or a portfolio. “

The problem with most physical assets is that their value is invariably derived from the value of the underlying income, with which the customer buys the assets.

“If we pick an asset whose (relative) value to paper money does not change over time, the money earned by the volatility is real”

The Dow Jones is near a historical high, even as the DXY Index is at a mid-term high. For a currency almost guaranteed to break

Throughout history, there have been occasions when mankind has gone into frenzied bubbles and then seen them collapse, impoverishing the innocent. The patterns are not

The current Chinese Coronavirus 2019-nCoV allows us to understand how we handle Uncertainty. One of the big contributors to Uncertainty is Unpredictability, which is nothing

For the past 25 years, Sanjeev has been on a passionate quest to understand the mysteries of human irrationality. As a student of behavioral economics, Sanjeev has dedicated his career to exploring the many ways in which people make decisions that defy logic and reason. Through years of research, Sanjeev has delved into the intricate interplay between cognitive biases, social pressures, and economic incentives that shape our choices and behaviors. With a keen eye for detail and a deep understanding of human psychology, Sanjeev has shed light on some of the most perplexing and fascinating aspects of our decision-making processes.

Mentorship for All Backgrounds

Through this program, participants will learn the fundamentals of investing, including how to evaluate different investment options, assess risk, and build a diversified investment portfolio. They will also receive guidance on developing a personalized investment strategy that aligns with their goals, risk tolerance, and values.

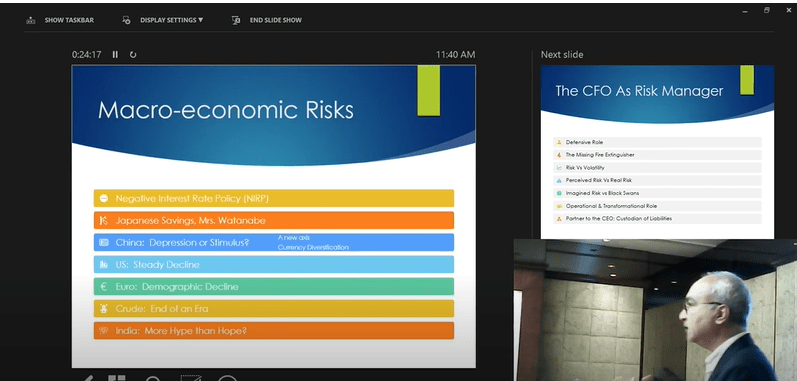

A talk by Sanjeev Pandiya on 17th November, 2019, at JB NAGAR CPE Study Circle of WIRC of ICAI on the topic of the direction of where the world economy is headed and how we should we think about it.

Sanjeev Pandiya talks about his value pick Tatasteel in 2019 in an investors’ meeting at Pune. He provides a 3-dimentional perspective on Global Steel Industry and where it’s heades.

In this video, Sanjeev explores how principles of behavioral economics can help us understand the complexities of markets. Throughout the video, he uses visual aids and engaging examples to make the concepts and applications of behavioral economics accessible and relevant to a broad audience.

On 22nd November, 2019, Sanjeev Pandiya was invited to present his stock idea at the prestigious Alpha Ideas 20-20, which was covered by Bloomberg. Here is talks Steel Industry and his value pick ‘Tata Steel’.

In this video, Sanjeev Pandiya talks about his value pick UPL at the 20-20 Ideas Summit by Tamilnadu Investors Association. More than the stock prices, Sanjeev emphasizes the process of valuation and a robust definition of Value.

The Dow Jones is near a historical high, even as the DXY Index is at a mid-term high. For a currency almost guaranteed to break

Throughout history, there have been occasions when mankind has gone into frenzied bubbles and then seen them collapse, impoverishing the innocent. The patterns are not

As a participant in the Dr Mentoring Program (DMP) four years ago, I can say with confidence that the program has been instrumental in shaping my approach towards managing operating cash flow and developing strategies for becoming a successful doctor entrepreneur.

Under the guidance of Mr. Sanjeev Pandiya, a seasoned ex-CFO of many listed companies like SRF, Jindal Steel, and Haulonix, the program provided us with invaluable insights into the financial aspects of running a medical practice. From understanding the basics of accounting and financial statements to learning about cash flow management, the program covered all the essential concepts required to successfully run a medical practice.

Moreover, Mr. Pandiya’s expertise and guidance helped us develop a strategic mindset to approach our profession as entrepreneurs. We were taught how to think outside the box and innovate to create unique offerings and build a brand that sets us apart from the competition.

Overall, I can confidently say that the DMP has had a profound impact on my professional growth as a doctor entrepreneur. The program’s emphasis on financial management and strategic thinking has equipped me with the tools to build a successful and sustainable medical practice. I would highly recommend this program to any doctor looking to enhance their entrepreneurial skills and take their practice to the next level.

Regards,

Dr Yatin Shinde

Indapur

Please fill this form to get the invitation for my weekly webinars that I conduct for our community. In these sessions I talked about wide range of subjects like investing, personal finance and answer the questions you might have.

Please fill this form below to join this community of like minded individuals with a common objective ,to build a 3-dimentional understanding of the investing world.